In the ongoing battle against corruption and tax evasion, transparency regarding company ownership plays a pivotal role. The absence of beneficial ownership information not only harms national economies but also creates opportunities for criminals to exploit the legal system.

Global Tax Evasion Concerns

Current estimates indicate that tax evasion imposes an alarming $427 billion in annual losses on governments globally, emphasizing the need for robust measures. Beneficial Ownership Registers play a vital role in deterring money laundering, terrorist financing, and exposing those concealing ownership of corporate entities.

EU Access Challenges

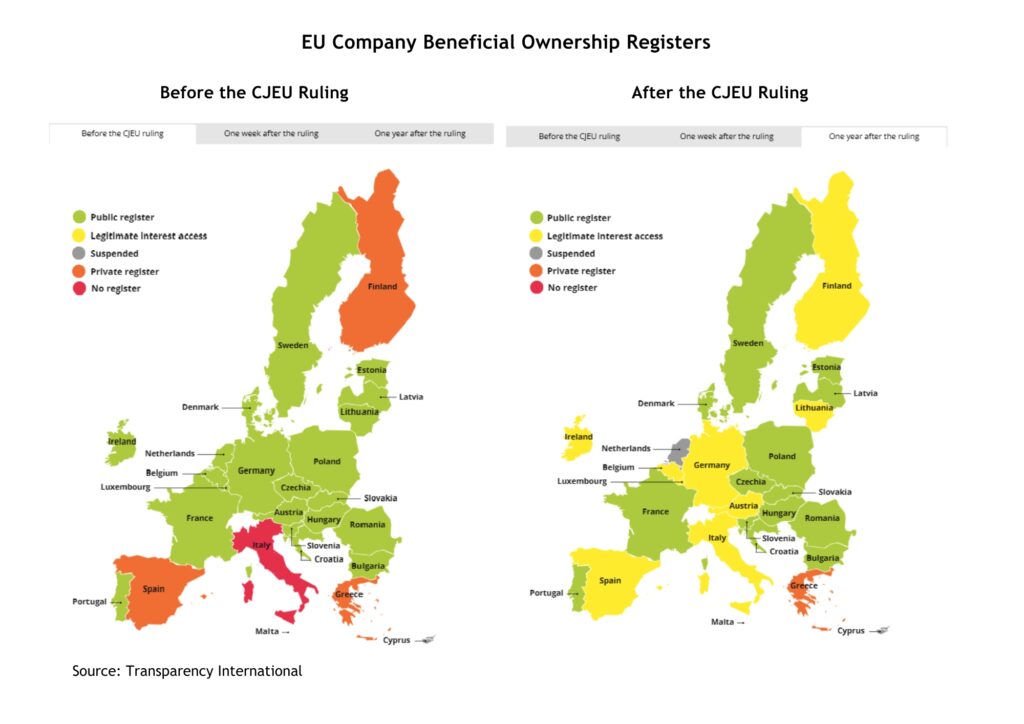

Over the past year, journalists and civil society organizations in the European Union (EU) have faced obstacles in accessing information on company ownership due to the CJEU ruling annulling parts of the AMLD5. Despite the CJEU emphasizing the role of journalists and civil society, access remains restricted in 13 out of 27 member states, according to Transparency International. Disparities exist, with some countries implementing varied systems, while others consistently deny access, highlighting the need for harmonized regulations.

Legitimate Interest Regulation

The CJEU ruling introduces a presumption favoring access for journalists and civil society, now part of the proposed 6th AMLD. However, member states exhibit diverse approaches to defining and regulating legitimate interest access, ranging from case-by-case demonstrations to general access for registered entities.

Country-Specific Approaches

- Ireland: Adopts a highly restrictive approach, requiring connections to money laundering or terrorist financing offenses, posing challenges for journalists and civil society access.

- Italy: Permits limited access, only to individuals with a relevant legal interest, with no defined criteria for review, potentially hindering transparency efforts.

- Luxembourg: Features informal agreements that favor local journalists, while foreign counterparts face restrictions, showcasing disparities in access.

- Germany: Conducts case-by-case analysis of legitimate interest, necessitating registration, detailed information, and potential delays in accessing beneficial ownership information.

- Spain: Presents a comprehensive response, with a presumption of legitimate interest for media and civil society. However, specific treatments for freelance journalists remain unclear.

Harmonization Call

The varied approaches across member states underscore the need for harmonized regulations. The 6th AMLD provides an opportunity to address CJEU rulings comprehensively and establish standardized access practices for beneficial ownership registers.

The challenges in accessing beneficial ownership information within the EU highlight the urgency for harmonized regulations. A unified approach is essential to ensure transparency, accountability, and the effective fight against global financial crimes in the ever-evolving landscape of the global financial system.