The Financial Action Task Force (FATF) and the European Union (EU) maintain lists designating countries with weak measures to combat money laundering and terrorist financing (AML/CFT). With 3 countries black-listed and 21 grey-listed, the urgency of addressing strategic deficiencies is evident. Belize, previously grey-listed after receiving a negative assessment from the OECD Global Forum, managed to exit the EU’s Annex 1 listing by February 2024 and successfully navigated compliance challenges, offering hope for others facing similar struggles.

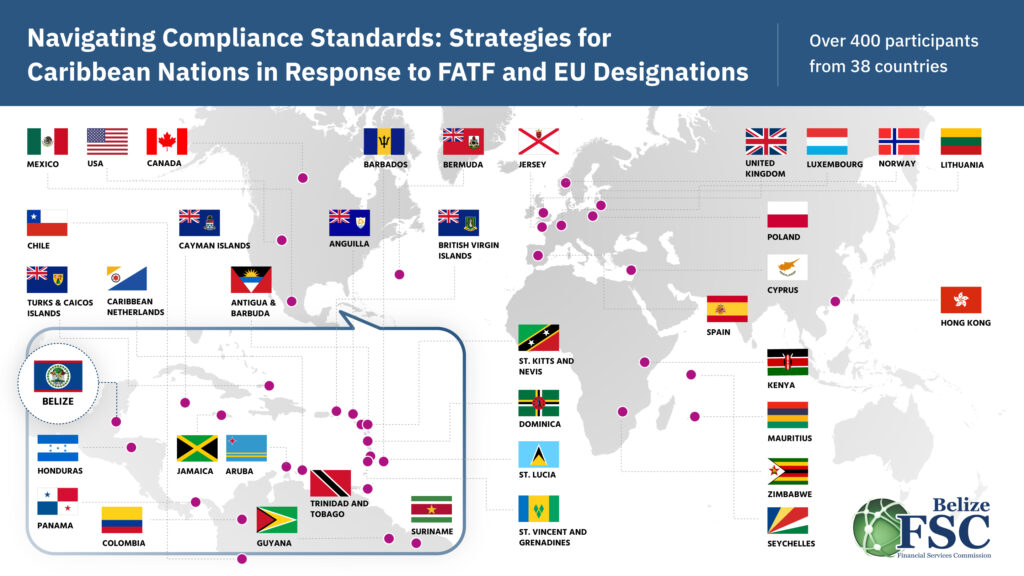

Amidst this backdrop, the Financial Services Commission (FSC) Belize took proactive steps by organizing a free webinar titled “Navigating Compliance Standards: Strategies for Caribbean Nations in Response to FATF and EU Designations” on April 23, 2024.

The webinar aimed to provide insights into Belize’s successful removal from the EU’s list, offering valuable lessons in strategic diplomacy and regulatory adherence. With over 400 participants from 38 countries worldwide, including policymakers and high-level government officials, the webinar underscored the global significance of addressing AML/CFT challenges.

During the webinar, participants engaged in high-level dialogue, focusing on combating money laundering and terrorist financing in the Caribbean. Expert presentations delved into the economic, financial, and societal impacts of designation as a high-risk jurisdiction, emphasizing the need for collaborative solutions.

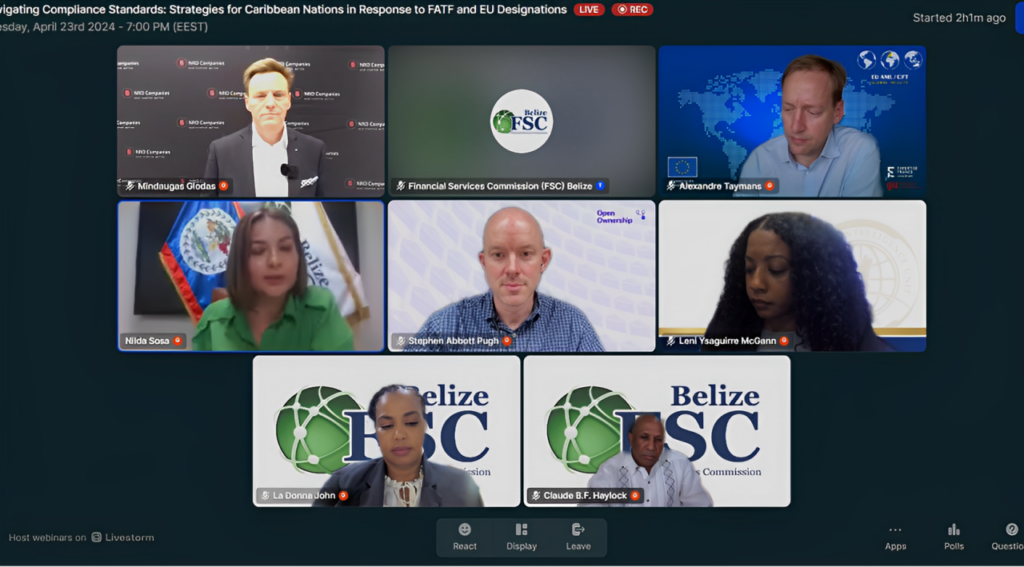

As a technical partner, NRD Companies’ role in the webinar was twofold: acted not only as speakers, offering expertise and insights, but also provided crucial technical support behind the scenes. We are proud to support FSC Belize , whose leadership and unwavering dedication have played a vital role in driving significant dialogue within the region.

Information About Speakers

Mr. Claude B.F. Haylock, Director General and Deputy Chairman of the Financial Services Commission (FSC) of Belize since September 1, 2017, oversees the regulation and supervision of the “non-bank” financial services sector. Additionally, he serves as the Registrar of Companies, Registrar of Merchant Shipping, and the Registrar of numerous other legal entities, including NGOs/NPOs, Foundations, and Trusts. He opened the webinar with a warm welcome and an opening keynote.

Ms. La Donna John, Director of Legal and Enforcement at the Financial Services Commission of Belize, presented Belize’s experience as a case study following the recent removal of the country from the EU’s list of high-risk countries for tax purposes.

Download the presentation here.

Mrs. Leni Ysaguirre McGann, Director of the Financial Intelligence Unit of Belize (FIU) discussed the issues facing Belize in the CFATF mutual evaluation process and the steps the country took to address recommendations via National Coordination Mechanisms and new legislation.

Download the presentation here.

Mr. Alexandre Taymans, Key Expert on Beneficial Ownership at the European Union AML/CFT Global Facility discussed navigating EU requirements with a focus on Anti-Money Laundering (AML) compliance and sanctions. The central theme revolved around understanding the Ultimate Beneficiary and the significance of its data. Mr. Taymans offered roadmaps to achieve compliance, highlighting crucial oversight areas, and presenting case studies of countries showcasing good governance practices.

Download the presentation here.

Mr. Mindaugas Glodas, CEO at NRD Companies, focused on the critical aspect of understanding the Ultimate Beneficiary and its data, and its intersection with technology. Drawing from experiences in Africa and the Caribbean, the discussion explored strategies to effectively utilize technology.

Download the presentation here.

Mr. Stephen Abbott Pugh, Head of Technology at Open Ownership (UK) discussed technical assistance in implementing beneficial ownership transparency, highlighting the importance of data quality – “High quality data leads to high quality insights”.

Download the presentation here.

Key Takeaways

Understanding the FATF’s Evaluation Process: Participants gained valuable insights into the FATF’s evaluation criteria, methodology, and implications of being labeled a high-risk jurisdiction. The webinar provided clarity on the specific areas of concern identified by the FATF and outlined the steps necessary to address deficiencies in anti-money laundering and counter-terrorism financing measures.

Navigating Compliance Challenges: Amidst growing regulatory complexity and compliance burdens, the webinar offered practical guidance on navigating the regulatory landscape and implementing robust anti-money laundering frameworks. Participants explored strategies to enhance compliance, mitigate risks, and strengthen due diligence practices to safeguard against illicit financial activities.

Enhancing Regional Cooperation: Recognizing the transnational nature of money laundering, the webinar underscored the importance of fostering regional cooperation and collaboration among Caribbean nations. Participants discussed the need for information sharing, exchange of best practices, and steps required to remove countries from high-risk lists.

Investing in Technology and Innovation: Embracing technological solutions emerged as a key theme during the webinar, with discussions focusing on the importance of enhanced regulatory compliance and the use of advanced tools to comply with AML/CFT standards and beneficial ownership requirements.

Building Stakeholder Awareness and Engagement: The webinar emphasized the importance of raising awareness and fostering stakeholder engagement in the fight against money laundering. Participants discussed strategies for educating the public, empowering financial institutions, and enhancing transparency and accountability in the Caribbean’s financial sector.

Mr. Claude Haylock, Director General of the Financial Services Commission of Belize, remarked, “We are delighted to have facilitated such an insightful and impactful webinar on combating money laundering in the Caribbean. The exchange of ideas, expertise, and experiences among stakeholders has laid a solid foundation for future collaboration and action through Private-Public Partnerships (PPPs). Together, we can effectively tackle the challenges posed by money laundering and uphold the integrity of our financial system.”

The event served as a catalyst for dialogue, knowledge transfer & exchange, and collective action towards strengthening the region’s resilience against financial crime by way of adopting strategies to effectively utilize technology.

For more information about the webinar, please visit FSC website https://www.belizefsc.org.bz/eventspage/.

Unlock Transparency & Accountability

Join the league of nations committed to enhancing financial integrity and promoting global transparency. Secure your financial systems with cutting-edge solutions. Request a demo now to witness the future of streamlined ownership management.

Thank you!

We will contact you soon!