In the current financial landscape, the lack of transparency surrounding beneficial ownership poses a significant challenge in combatting corruption, tax evasion, and illicit financial activities. Without comprehensive Beneficial Ownership Registers, identifying the true beneficiaries behind legal entities becomes increasingly difficult, leading to loopholes exploited by criminals. It’s crucial to establish robust mechanisms for identifying and recording beneficial owners, even amidst complex ownership structures, to ensure accountability and deter illicit financial practices.

Defining Beneficial Owners

But who exactly are considered beneficial owners? According to Article 3(6) of the Fourth Anti-Money Laundering Directive (4AMLD), a Beneficial Owner encompasses any natural person(s) who ultimately owns or controls a legal entity, whether through direct ownership of shares or voting rights, or via indirect means such as shareholders’ agreements or the power to appoint senior management.

– Direct Ownership: Holding more than 25% of shares.

– Indirect Ownership: Controlling more than 25% of voting rights.

– Control via Other Means: Exercising influence through various mechanisms outlined in Recital 13 of 4AMLD.

In the case of subsidiaries, individuals holding or controlling 25% plus one share in the parent entity are considered beneficial owners of the subsidiary.

Identifying Beneficial Owners

To address the challenge, countries must prioritize the establishment of robust Beneficial Ownership Registers. The Financial Action Task Force (FATF) has advocated for greater transparency, particularly through Recommendation 24, emphasizing the importance of granting competent authorities access to accurate and up-to-date beneficial ownership information.

Global Progress

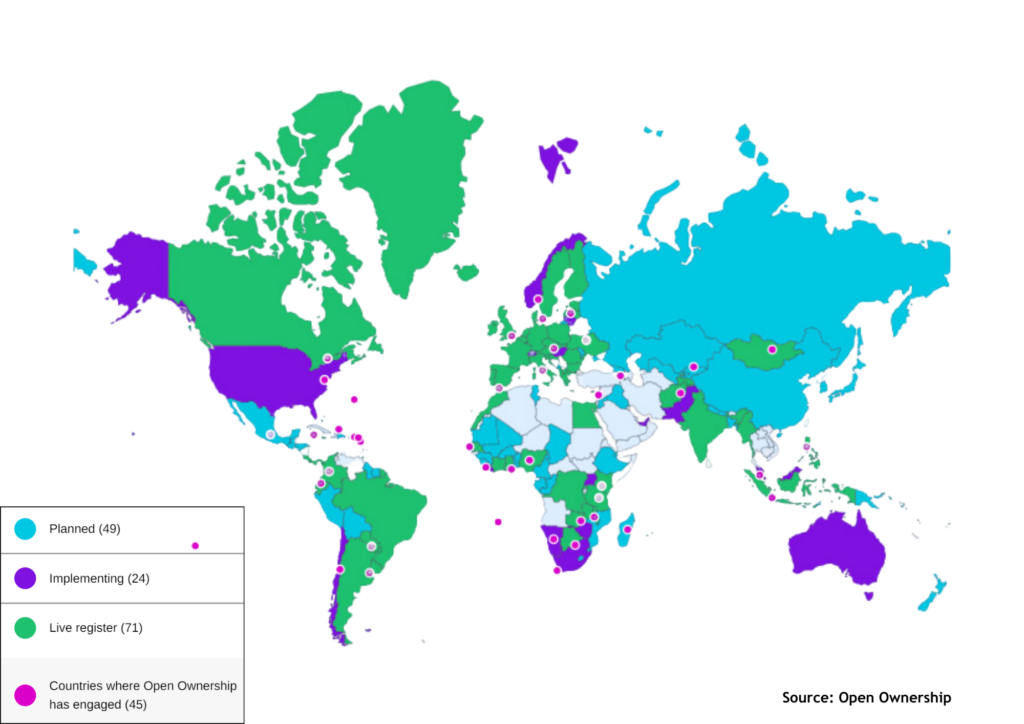

Open Ownership has developed an interactive map showcasing the progress: as of 2023, 71 countries have established beneficial ownership registers, with 24 in the implementation phase and 49 planning to do so.

Innovation in Action

As we seek solutions to enhance transparency in beneficial ownership, technology and legal expertise converge in a powerful combination. Through our BOREG© module, we offer a comprehensive Beneficial Ownership Registry solution. Seamlessly streamlining secure data collection, storage, and transfer, this innovative technology incorporates global sanctions and AML screening. In doing so, it not only expedites the establishment of beneficial ownership registers but also ensures compliance with FATF recommendations, actively promoting transparency and integrity within the financial system.

How is your jurisdiction utilizing technology to expedite the establishment of beneficial ownership registers, ensuring compliance with FATF recommendations for accurate and up-to-date information?

Join the Discussion

Share your jurisdiction’s strategies for establishing beneficial ownership registers and staying compliant with FATF standards.

Thank you!

We will contact you soon!